Kentuckiana's #1 Small Business Lender

As the leading SBA 504 lender in Kentuckiana, we are happy to provide you with valuable information that will assist you in obtaining the best possible financing for your company's project.

Apply Now

Many businesses encounter problems when seeking long-term financing

Recognizing this, we administer and team with the U.S. Small Business Administration (SBA) to offer the 504 Loan Program to give businesses a financing alternative.

Learn About Our Program

Resources on the 504 Loan Program

SBA Loan Rules: A Boost for Small Business Financing

Empowering Entrepreneurs: Navigating the SBA 504 Loan Program

How We Support Businesses Purchasing Land in Kentucky

Down Payment for SBA 504 Loans: What You Need to Know

Benefits of the SBA 504 Loan Program for Business Owners Looking to Purchase Real Estate Property

Understanding the Best Loan Structure – Specific to You

Stay on top of all things finance by signing up for our monthly newsletter:

How it Works

Each 504 loan package has three elements:

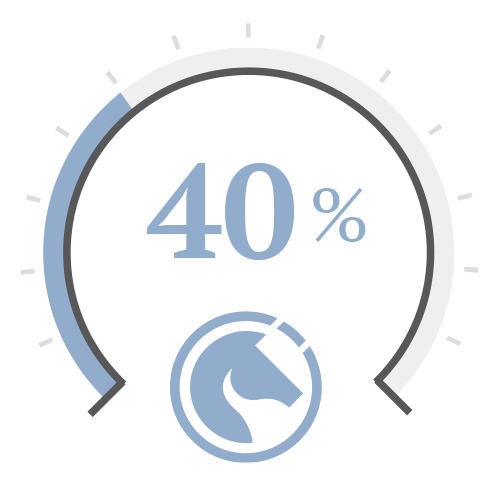

CAPITAL ACCESS

We lend up to 40 percent of the total fixed asset financing need, to a maximum of $5,000,000*.

BANK / LENDER

A private lender, usually a bank, lends up to 50 percent of the project's total cost.

YOUR BUSINESS

The business provides a minimum of 10 percent of the necessary funds.

(Higher equity requirements exist for start-up or leveraged companies in specialized industries.)

*This amount can be increased to $5,500,000 for manufacturing concerns or “green” projects (projects that create at least 10% reduction in energy consumption. See tab on Green Projects for more information).

The interest rate on our loans are fixed and generally a little above the rate of long-term Treasury Bonds. The loan maturity is 10, 20, or 25 years. The interest rate on the companion bank loan is negotiated by the borrower and typically is floating. Calculate your loan

Advantages of Choosing Us

a financing alternative

Our combination of fixed and floating interest rate financing provides an effective hedge against unfavorable interest rate fluctuations. If rates increase, the borrower has locked in the relatively low Capital Access Corporation-Kentucky rate on up to 40 percent of the financing. If rates decrease, the borrower floats downward with the bank's loan.

Our Partner Banks