Many businesses encounter problems when seeking long-term financing. Recognizing this, we administer and team with the U.S. Small Business Administration (SBA) to offer the 504 loan program to give businesses a financing alternative.

The SBA 504 loan program is a great option for entrepreneurs or small businesses that need financing for major fixed assets, such as real estate or equipment. However, there are a few different loan structures available under the 504 program, and the best structure for you will depend on your specific circumstances.

Now, let’s discuss the different 504 loan structures and how to choose the best one for your business.

What is a 504 loan?

A 504 loan is a long-term, fixed-rate loan that is guaranteed by the Small Business Administration (SBA). The SBA partners with Certified Development Companies (CDCs), like us, to provide 504 loans to small businesses.

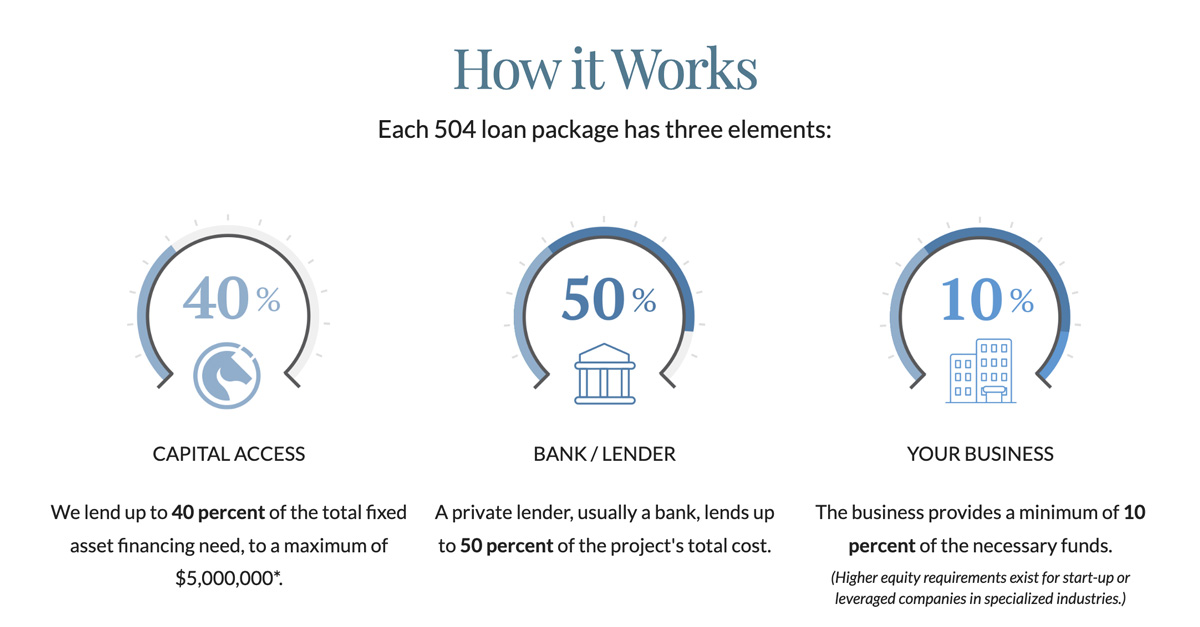

As stated above, 504 loans are typically used to finance major fixed assets and we can help finance up to 40% of the loan. Here’s the advantage when choosing us: partnering with us also gets you connected to a bank that can offer up to 50% of your need, leaving a 10% responsibility to you.

The different 504 loan structures:

- Direct loan: The borrower receives a loan directly from the SBA. This is the simplest 504 loan structure, but it is also the most difficult to qualify for.

- Intermediate loan: The borrower receives a loan from a participating bank, and the SBA guarantees a portion of the loan. This is the most common 504 loan structure.

- Combined loan: The borrower receives a loan from a participating bank, and the SBA guarantees the entire loan. This structure is available to businesses that are unable to obtain conventional financing.

How to choose the best 504 loan structure for your business

The best 504 loan structure for your business will depend on a number of factors, including:

- Your credit score: The better your credit score, the more likely you are to qualify for a direct 504 loan.

- Your financial need: If you need a large loan, you may want to consider a combined 504 loan.

- Your ability to repay the loan: You will need to be able to repay the 504 loan, plus interest, over the life of the loan.

If you are not sure which 504 loan structure is right for you, give us a call. We can help you assess your needs and recommend the best loan structure for your business.

Here are some additional tips for choosing the best 504 loan structure for your business:

- Consider your long-term goals. If you plan to grow your business significantly in the next few years, you may want to consider a combined 504 loan. This will give you more financial flexibility as your business grows.

- Check your eligibility for a loan. This will give you an idea of how much you can borrow and what your monthly payments will be.

- Make sure you understand the terms of the loan. Before you sign any paperwork, make sure you understand all of the terms of the loan, including the interest rate, the repayment schedule, and any fees.

Give us a call or jump below to contact us. We’d love to help you choose the best 504 loan structure for your business – and get the financing you need to grow your business.